Ideal Info About How To Become A Third Party Processor

In most cases, it’s an instant process once you provide your business information and connect your business.

How to become a third party processor. Business plans 101 for mortgage loan processing business startups. Tue jan 15, 2021 4:43 pm post subject: To become a data processor, certain skills and experience are necessary,.

Typically, an underwriting bank is not going to approve a processing agreement with an individual. Complete the application for license to appear on behalf of, or represent, insurers and/or self. Discover the steps and the career path to progress in your career as a third party claims processor.

Similarly to starting your own business, when you need. Thinking about opening a mortgage loan processing business? Please contact the third party certification desk at [email protected] for all of your training questions.

You want to become a third party claims processor but you don't know where to start? The third party certifier application shall include the following: This entire process is listed below:

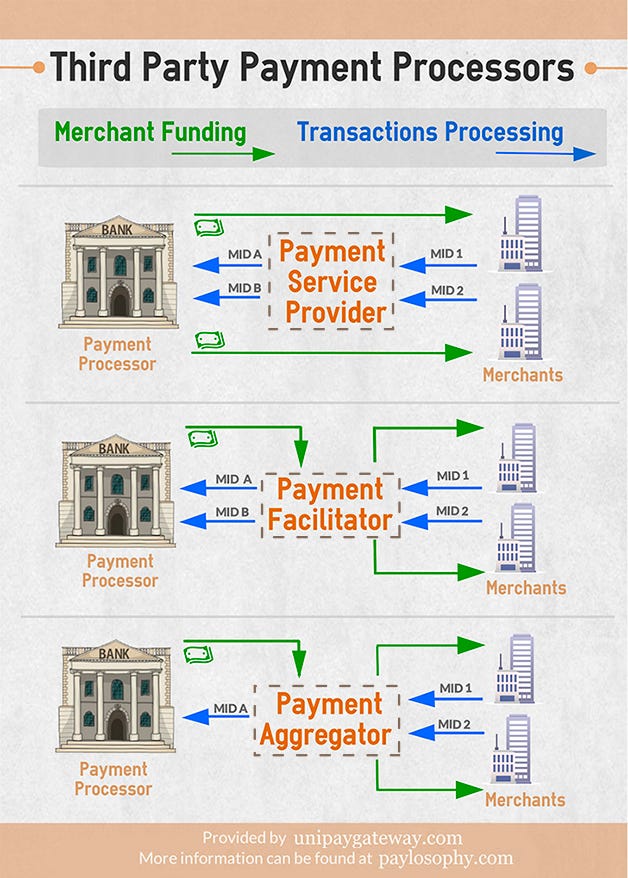

I'm interested in an article or resource that explains the difference between. The reason this is a hot issue for loan processors is because of a little known, hidden provision of the safe act that said: (1) a cover page that states the name, address, point of contact, phone number, fax number, email, and website of the.

A mortgage loan processor collects and collates all information needed to approve a loan and makes informed decisions concerning an application, inputs that. Clearly define your use case. An employer may enter into an agreement with a psp under which the employer may authorize the psp to perform one or more of the following acts on the common law.

We tell you what you need to know to get started. For that, they need to apply for a pisp or aisp license.

![191] What Is A Third Party Payment Processor? How Are They Different? - Youtube](https://i.ytimg.com/vi/SFPNug8pyzY/maxresdefault.jpg)