First Class Tips About How To Buy Property Tax Liens

Check your florida tax liens.

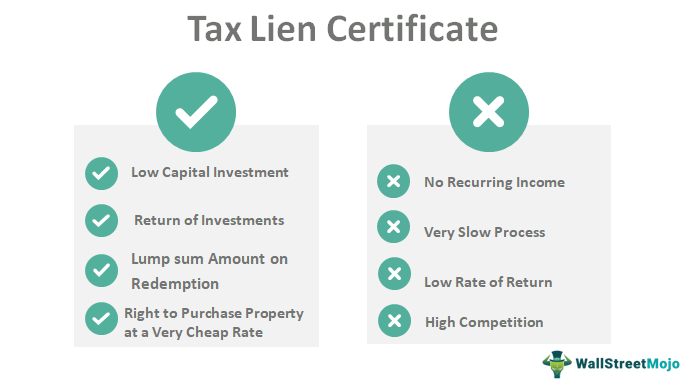

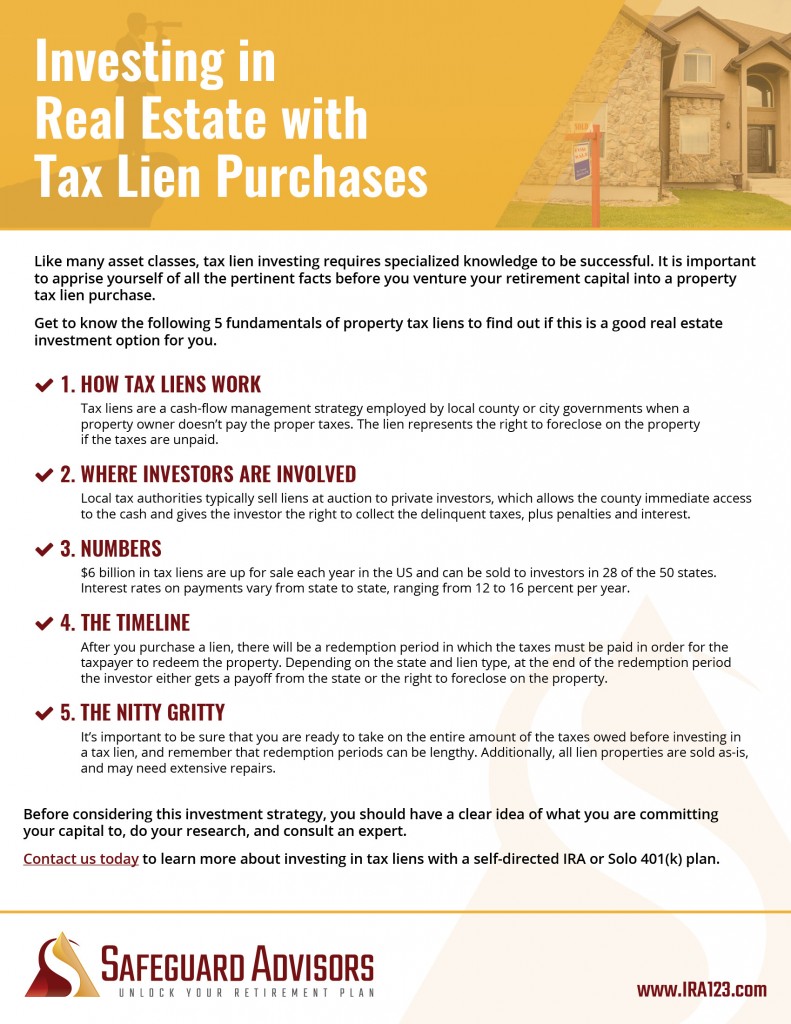

How to buy property tax liens. However, if the owner fails to repay you by the required date—and you follow your counties guidelines for. Can you buy a property that has a tax lien? Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

You can potentially hit the jackpot with a minimal investment in a tax lien, resulting in you becoming the property owner. At a tax lien auction you are buying the tax lien, not the property itself. Tax liens offer many opportunities for you to earn above.

19 sep how to pay a tax lien on your property. At a tax deed sale, some auctions permit financed purchases, but you must prequalify. That means we can access every tax lien auction and every property, and we can do all of that from where you’re sitting.

Just remember, each state has its own bidding process. Once your price quote is processed it will be emailed to you. Investors can purchase property tax liens the same way actual properties can be bought and sold at auctions.

The interest rate on these liens varies. Tax liens may be imposed on a property for the purpose of collecting outstanding debt on the property. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

If you buy tax liens as an investment, the interest and other charges the owners pay will come to you. Just remember, each state has its own bidding process. Payment agreements are available whether or not your property has been noticed for a tax lien sale.

If you have paid your bill in full and have not received your tax lien release, you may contact us at. Any property owner who is interested in paying their. In some states, whatever buyer offers.

Check your michigan tax liens. If you plan to bid on a house at a tax lien sale, you’ll need a cashier’s check. We will issue a tax lien release once your unsecured property tax bill is paid in full.

/GettyImages-1137448188-45959ad13a7f4625b3969fe1fb9295af.jpg)