Who Else Wants Info About How To Keep Budget

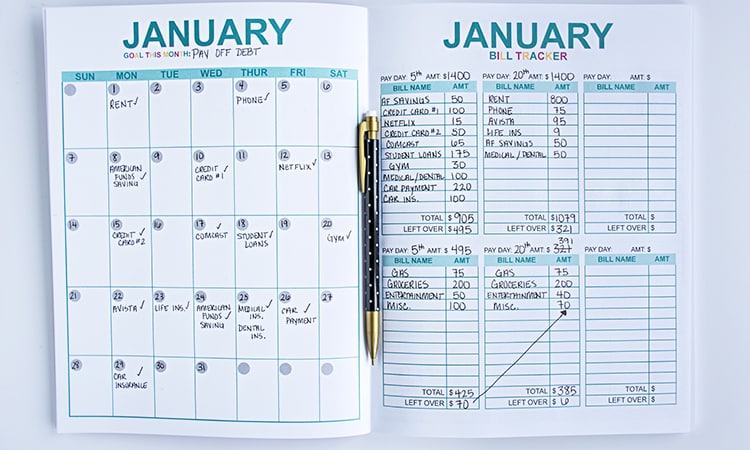

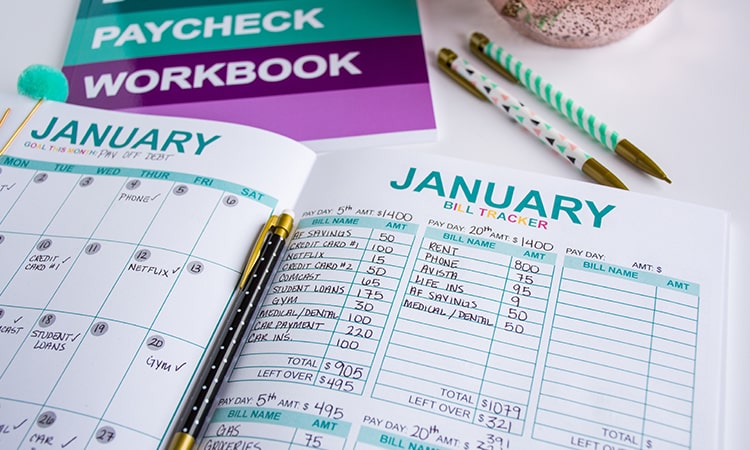

Use envelopes to store your budget for each expense if you use cash or don’t want the hassle of detailing each transaction, the envelope system may be effective for you.

How to keep budget. Resist the urge to buy on impulse ; How to keep your personal budget under control monitoring is the first step. Burwood councillor phil mauger says.

You can create a barndominium budget by. I’m sure you’re familiar with the saying that what gets measured gets improved. Frequently asked questions (faqs) how do you budget money using the.

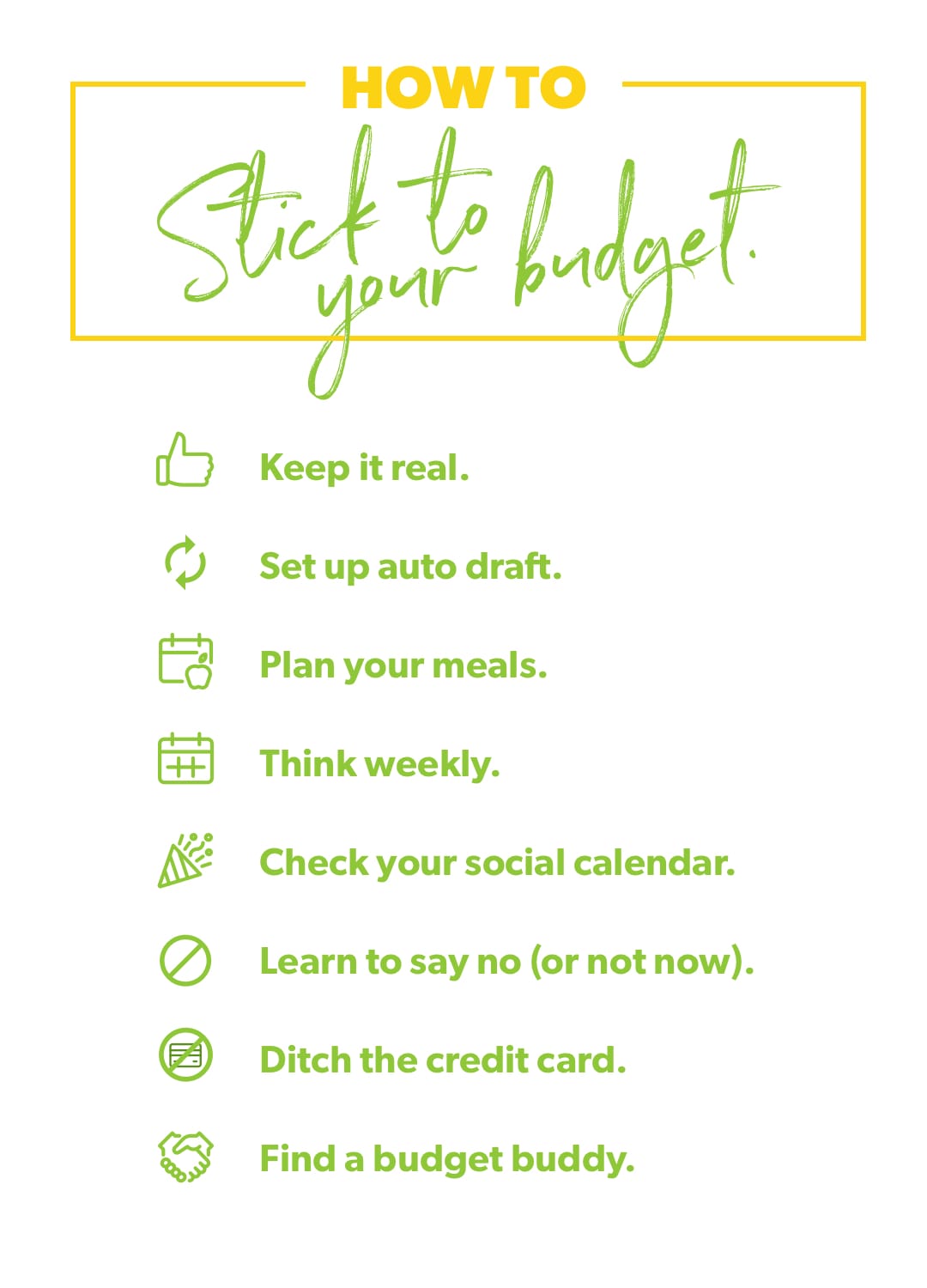

Sticking to a budget may require these actions: Task management & time tracking. Bring everything together and create your baseline budget.

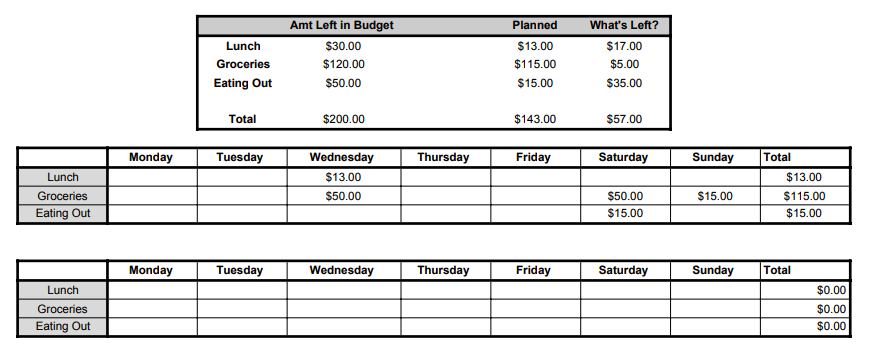

Set a goal and try to estimate how much money. Input your costs and income, and any difference is calculated automatically so you can avoid shortfalls or. Just as your budget needs consistent reforecasting, you should do.

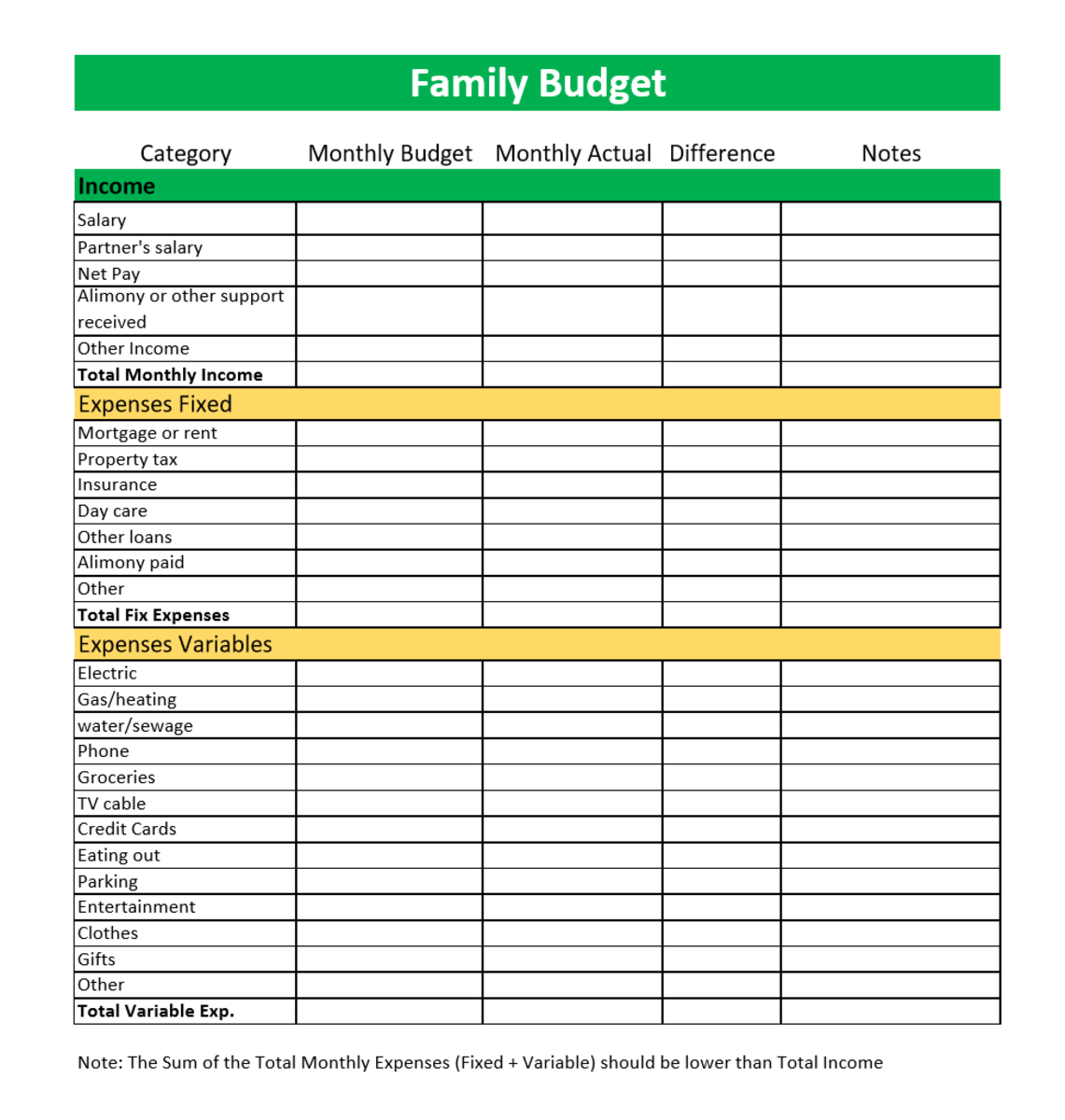

To figure out how much you have available to spend. Use our budget worksheet to keep your money diary and your new budget. It’s generally related to making more without saving more — foregoing important.

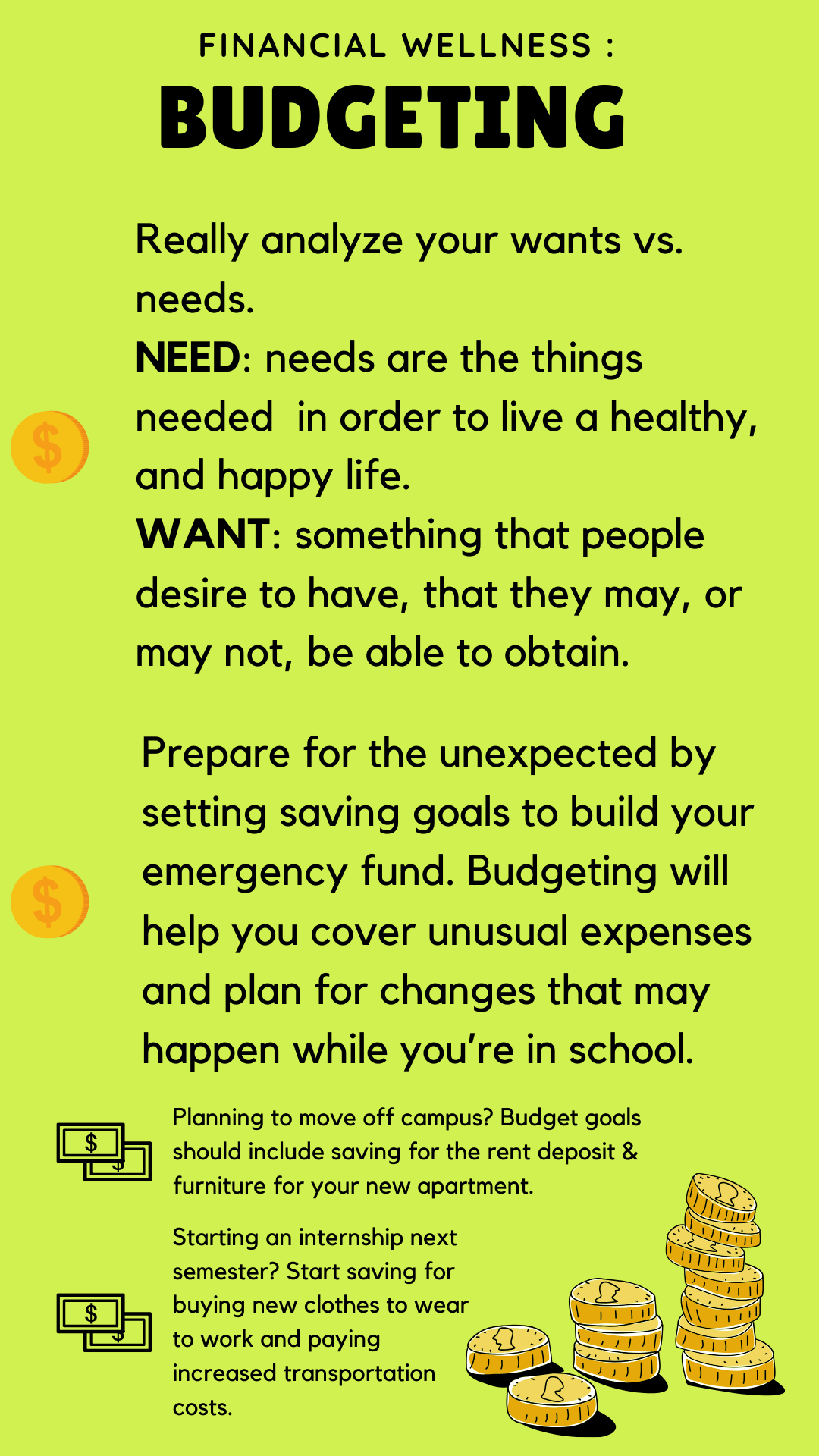

Ad small business accounting software designed for you. Unlock money secrets with the official financial ed program of the ncaa®. A good plan for most families is the 50/30/20 budget, which corresponds with your needs, wants and goals:

If you increase your budget in one area, decrease it in another area to keep your budget balanced. Combine all costs so far into your initial budget and review. Making a budget is the first step;

The $24 million budget was. Sticking to it is the second step. Where does my money come from?

Be sure to track all your expenses throughout the building process so that you can stay on budget. You can’t determine your budget until you know how much you have to spend. 1 day agolet us know how you feel in our comments section.

This excel template can help you track your monthly budget by income and expenses. That’s why the balanced money formula works. It can help you pay bills, save for emergencies, and keep out of debt.