Heartwarming Info About How To Reduce Debtor Days

Your terms and conditions should clearly state your payment.

How to reduce debtor days. Update your terms and conditions; Here are 7 ways to do that. Charge penalties for late payments:.

6 ways to reduce your creditor / debtor days 1. Tighten up credit approval effective credit control procedures begin. The best way to reduce your debtor days is to improve your risk analysis and credit control.

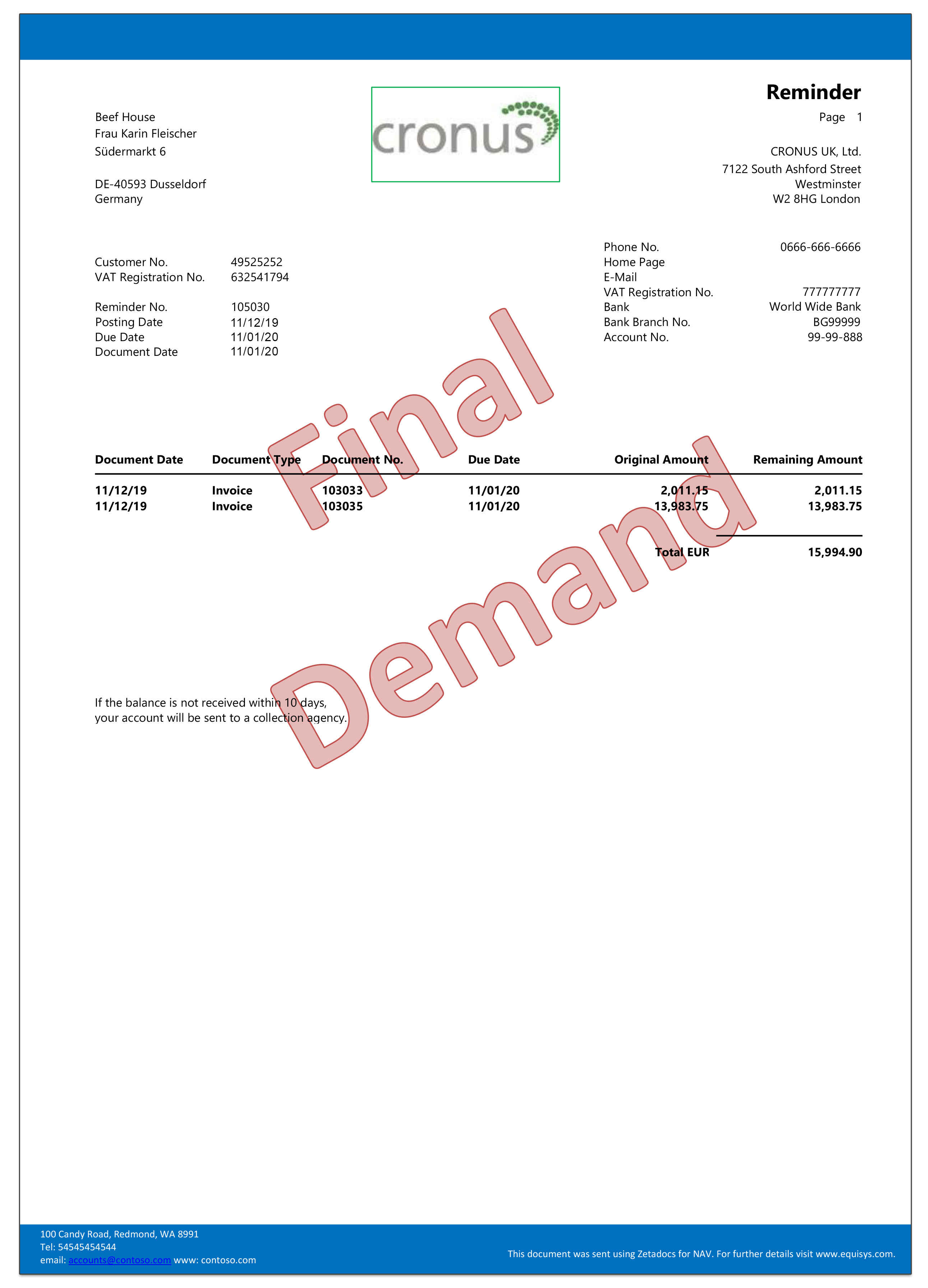

Here are a few tips to help you reduce your debtor’s days. Here ten ways that you can lower your days sales outstanding, which will improve your cash flow. Send out reminders at different periods, depending on how long your debtor days are.

These are my tips to reduce your debtor days: How to reduce debtor days make payment terms clear: You pick your suppliers based on your.

If your debtor days are 45 and your credit sales are £100,000 a month, your average debtor balance will be. But will reduce the cash flow critical to your business. When it comes to cash flow:

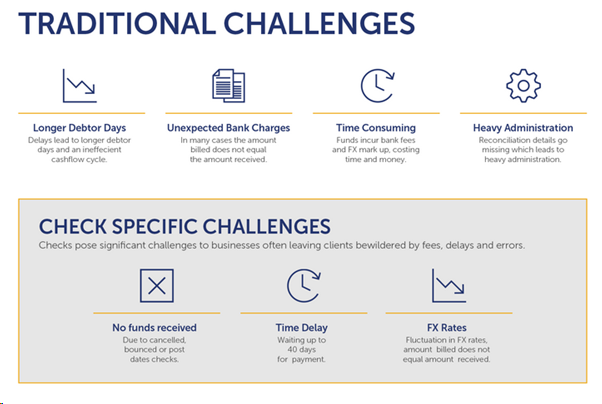

Setting up a clear and effective billing and collections process is crucial for the success of every business. Ways to reduce creditor and debtor days. Delayed payments and poor cash flow are a cause of stress for many businesses, with 69% of business owners admitting to having lost sleep due to cash flow worries.

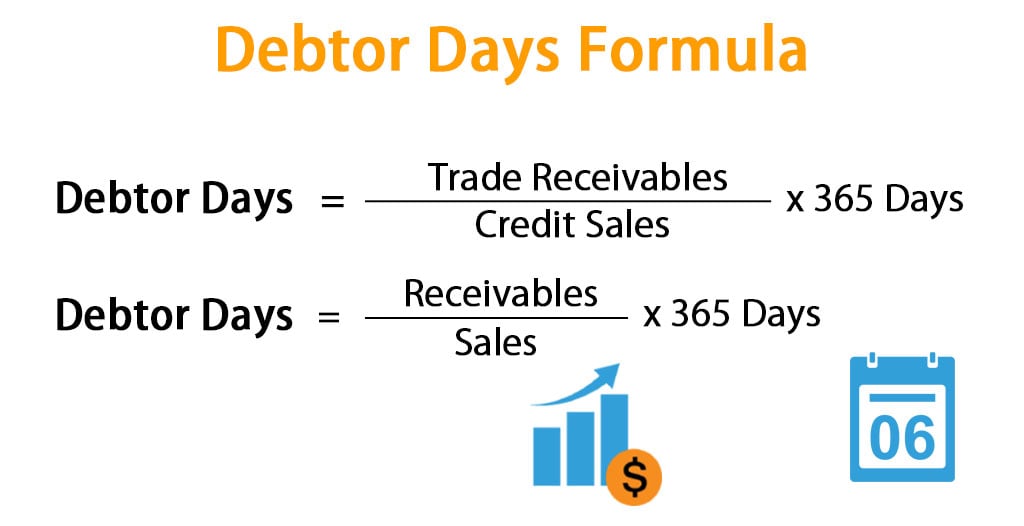

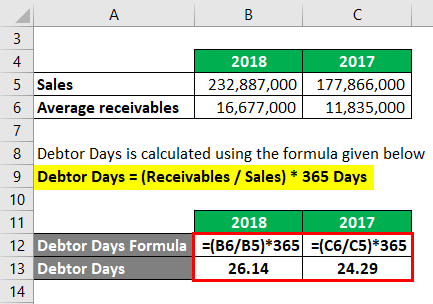

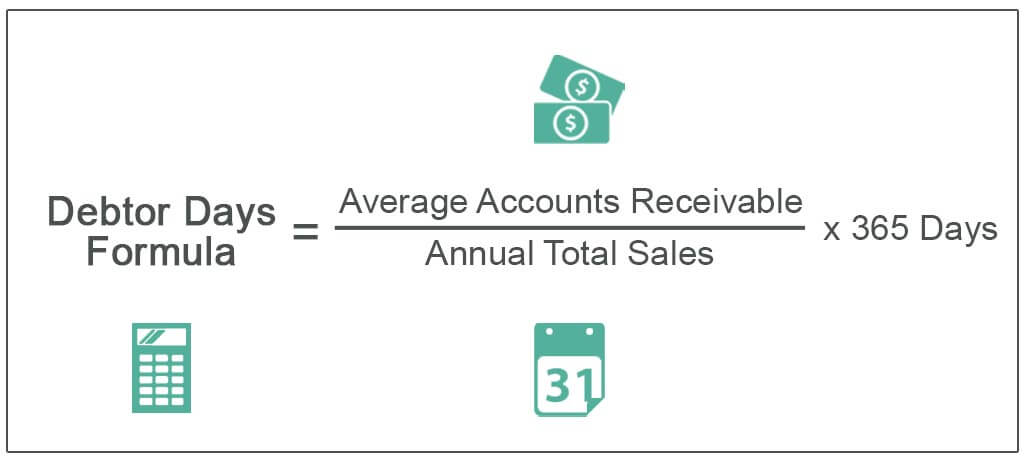

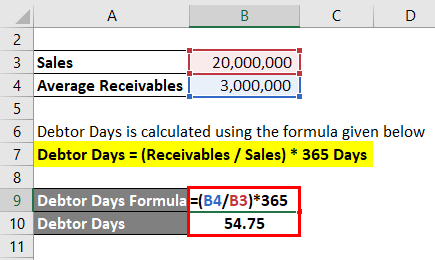

Negotiate payment terms with your suppliers. A third tactic to reduce debtor days is to introduce. Receivable days formula can also be calculated by dividing the average accounts receivable by the average daily sales.

These are 8 proven ways that can help to reduce debtor days: You can improve your risk analysis by performing regular credit checks on new and existing. In times when winning new business is a challenge, we can.

When creating an invoice, think about your messaging. Be clear and concise about the terms of payment. Avoid any confusion by issuing clear, straightforward invoices using a template that includes.

Be clear about terms of payment on your invoice the first, and perhaps. A larger number of debtor days means that a business must invest more cash in its unpaid accounts receivable asset,. You need customers to pay on time (and as quickly as possible) so you can run your business.