Peerless Info About How To Sell Mutual Funds India

The different ways in which you can sell or redeem mutual funds online are as follows:

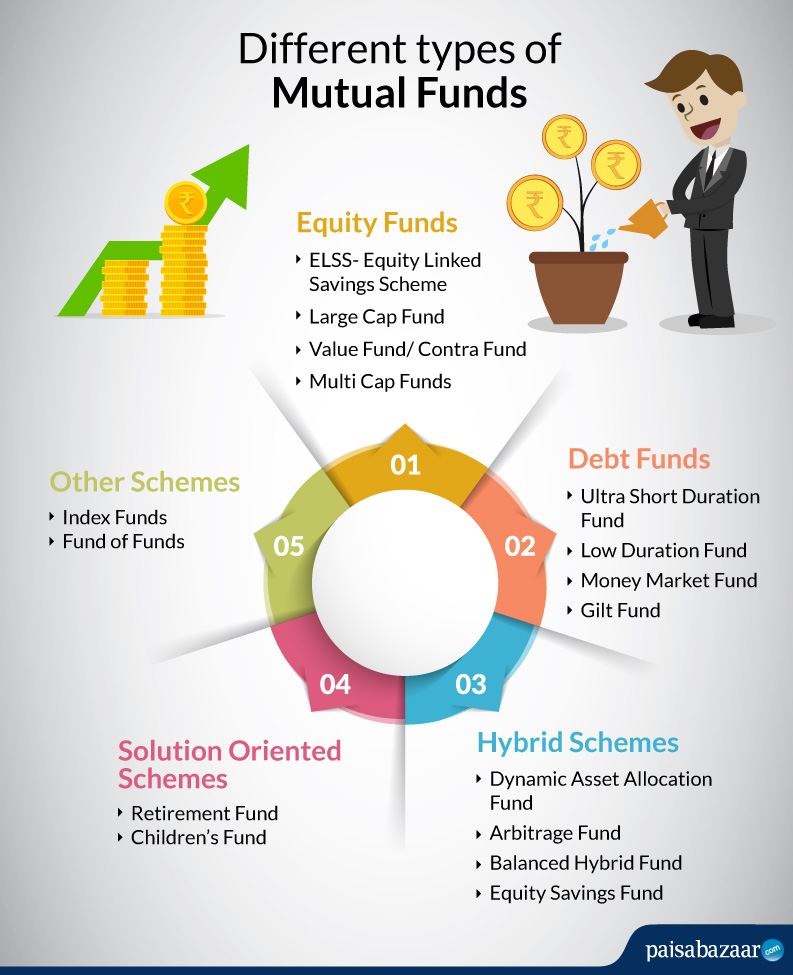

How to sell mutual funds india. These funds are classified into different categories based on the market cap of the stocks they invest in. Decide the number of units to sell for selling the specific number of units of mutual funds, you have to submit a signed form to the respective authority. In this article, we will be describing and.

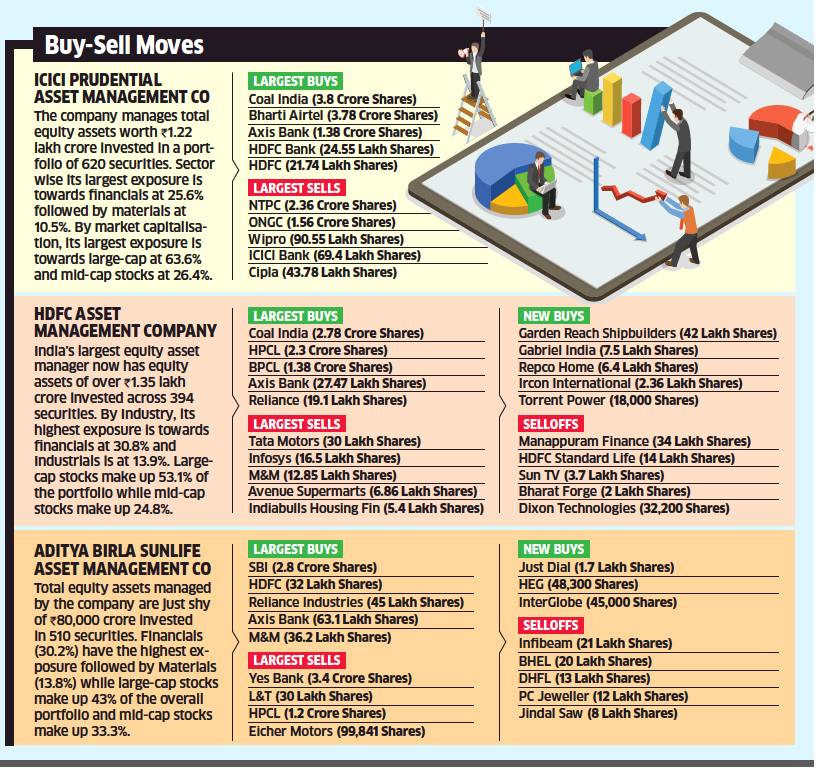

10 hours agomerger between lic mutual fund and idbi mutual fund is at a fairly advanced stage, a top official said on thursday. With technological advancements, you can invest in mutual funds through various apps and websites. It has to do with the way the mutual fund industry is set up and.

You may always invest in several types of financial. You do not have to visit any office or sign forms. It will ask your existing folio no etc.

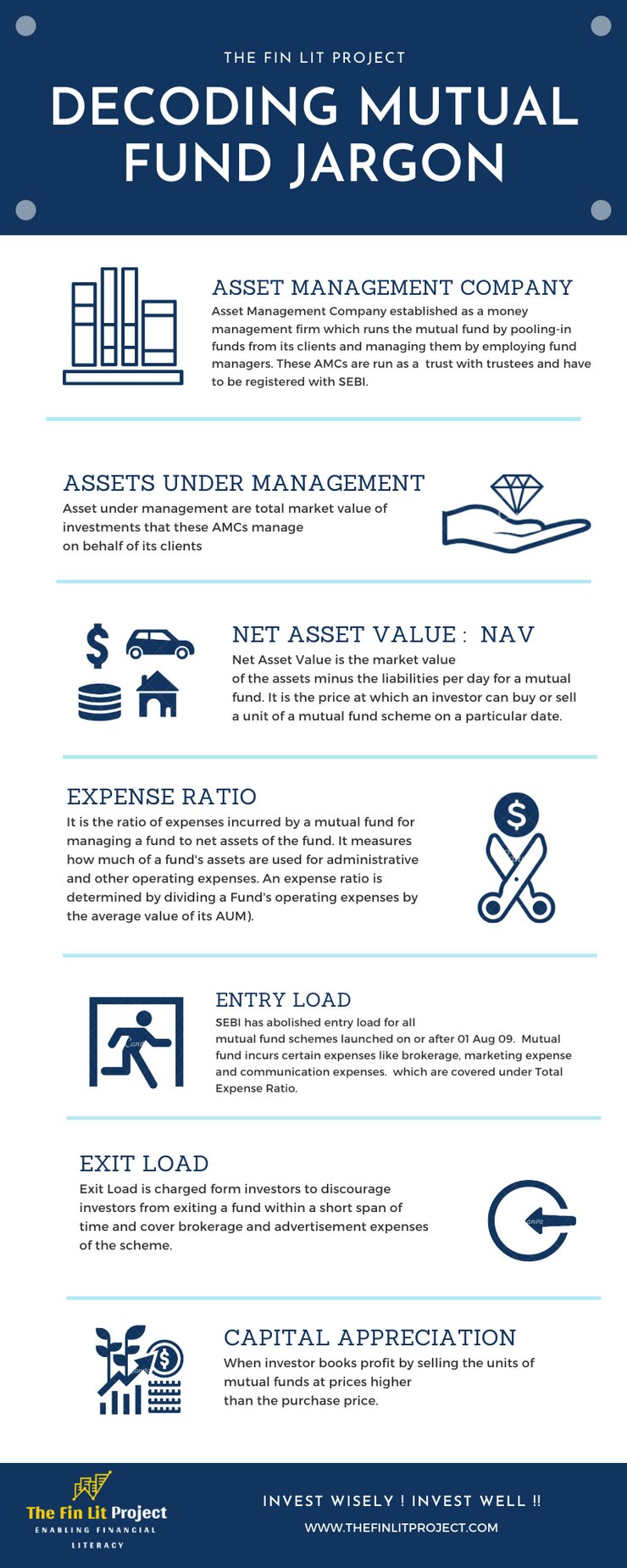

You can sell your mutual fund units directly through amc's website or visit their investor service centres. Steps to sell mutual funds are: When there's been a change of fund manager (s).

Hence, direct plans give higher returns than regular plans. Topping the list are the following scenarios: A recent report on mutual fund.

Redeem mutual fund through asset management company (amc) in case you have invested in the mutual fund directly from the amc, then you can approach the concerned. Sebi regulations stipulate that at least one of the. Go to the amc website.

Gilt funds have given double the returns compared to the blue chip funds in india. Mutual fund investments are investment vehicles where money is pooled from numerous investors in order to reduce risks related to mutual fund investments. Despite being available in the market, less than 10% of indian households have invested in mutual funds.

“it may be that the. Through the website or mobile app of the amc through the website or mobile app of. Equity funds invest a majority of their assets in stocks.

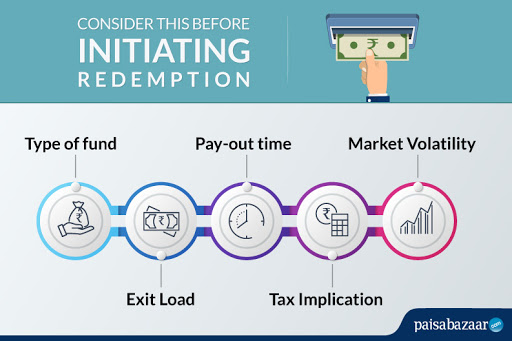

Earnings from mutual funds are either in the form of capital gains or dividends. The securities and exchange commission limits redemption fees to a maximum of 2%. Some times are more appropriate than others, for cashing out of a mutual fund.

When selling mutual funds, focus on the total return of investment. The process is on, it is at a fairly advanced stage, lic. The regular plans are sold through distributors and involve commissions.

/mfhistory.asp_final-a021d511916f4e88806ddb91b4c08e6c.png)