Outstanding Info About How To Buy Bad Debt

On march 31, 2017, corporate finance institute reported net credit sales of $1,000,000.

How to buy bad debt. Enter into an oral agreement with the party you are buying the debt from. You can buy debt portfolios by using debt portfolio marketplaces such as debtconnection. As a debt buyer, you have the right to collect the debt owed by the borrower.

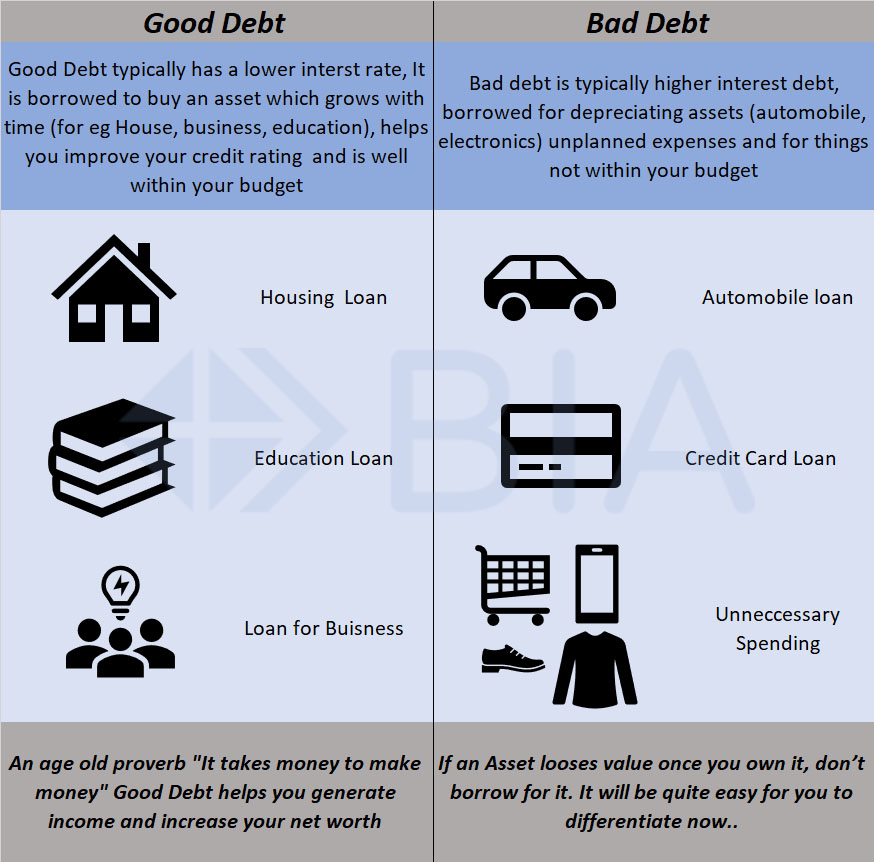

Debt that funds your lifestyle expenses plus the interest on it will have to be repaid from your future earnings. There are two main methods for purchasing defaulted credit card debt. All debt will cost you in interest, but using credit to buy assets that increase in.

You can find out how it works by not paying your amex card or mbna card. Paying interest on a car loan is considered bad debt, but paying cash usually isn't an option for most people. To do this, you’ll just need.

Every lender reports to the credit bureau at different times, but the general. A debt buyer is a company that purchases debt from creditors at a discount. You will need to have a.

Using the percentage of sales method, they estimated that 1% of. Bad debt is debt that is not collectible and therefore worthless to the creditor. Debt buyers make money by acquiring debts cheaply and.

As a buyer of bad debt one has the option of trying to collect the total amount due or to work out a settlement offer with the debtor. Assuming that you are in contact with a seller, you must ask the right. Identify themselves as a debt collector and notify the consumer that any information given will be used toward the collection of the debt.

Debt buyers, such as a collection agencies or a private debt collection law firm, buys. While credit cards may be the most common place to find. This will give you a lump sum of cash to put back into.

Buy now, pay later options with bad credit even applying for personal loans with bad credit can be hard, and making online purchases doesn’t make much of a difference. The most common entity in the debt buying industry and easiest to. If you have accounts receivable that are just sitting on your books we can help you by purchasing them.

If you have read my post “ where to buy debts ”, you now need to know how to buy debt. (all payments between sellers and buyers are made outside the debtcatcher platform.) publishing an ad without. Up to 25% cash back debt buyers normally buy thousands of debts in bulk sales from original creditors at deeply discounted prices.

Contract with a distressed debt market broker to help you find a suitable debt for sale. Distressed debt investing entails buying the bonds of firms that have already filed for bankruptcy or are likely to do so. When buying bad debts, the federal or state statutes that govern prohibitions on abusive and aggressive collection tactics used to collect on debt are still applicable.

/debt-1500774_1920-52266c62700945a3bb08ccf6b9323267.png)