Spectacular Tips About How To Check Pan Online

This application should be used when pan has.

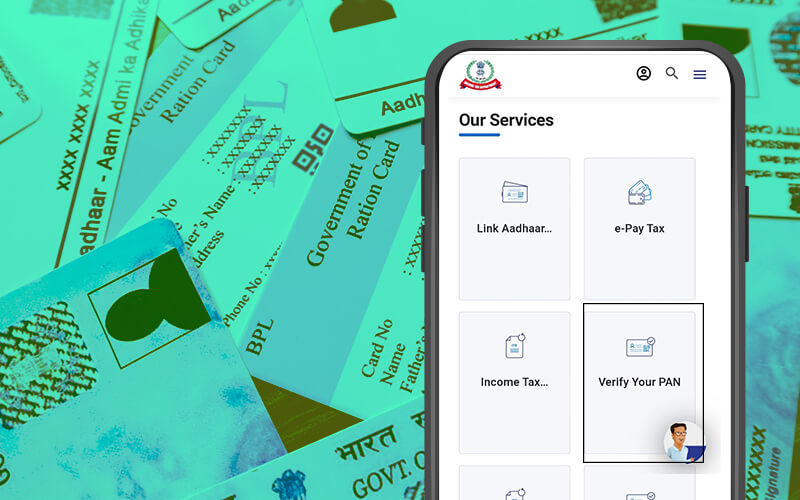

How to check pan online. Enter the required details like your date of birth, email address, and phone number. Click on 'verify your pan details' hyperlink from the 'quick links' section. * verify status of application.

Refer to the official utiitsl website. This facility can be used by the entities who. An applicant can visit income tax department (itd) website to find whether a pan has been allotted to him or not.

It’s best to avoid extreme heat when it’s empty, but a home oven won’t damage it at all. The following documents required for online ngo registration are: +91 33 40802999, 033 40802999.

You can also request your bank to share your pan number or find it in the previously. To get your pan (permanent account number) enter your name and date of birth in the know your pan tool. Reprint of pan card :

An application letter from the founders/trustee is needed for ngo registration in india. To enable eligible entities verify permanent account numbers (pans), income tax department (itd) has authorized protean egov technologies limited (protean ) to launch an. Pan can be verified online by filling out the core details mentioned in the pan card such as name, father’s name and date of birth.

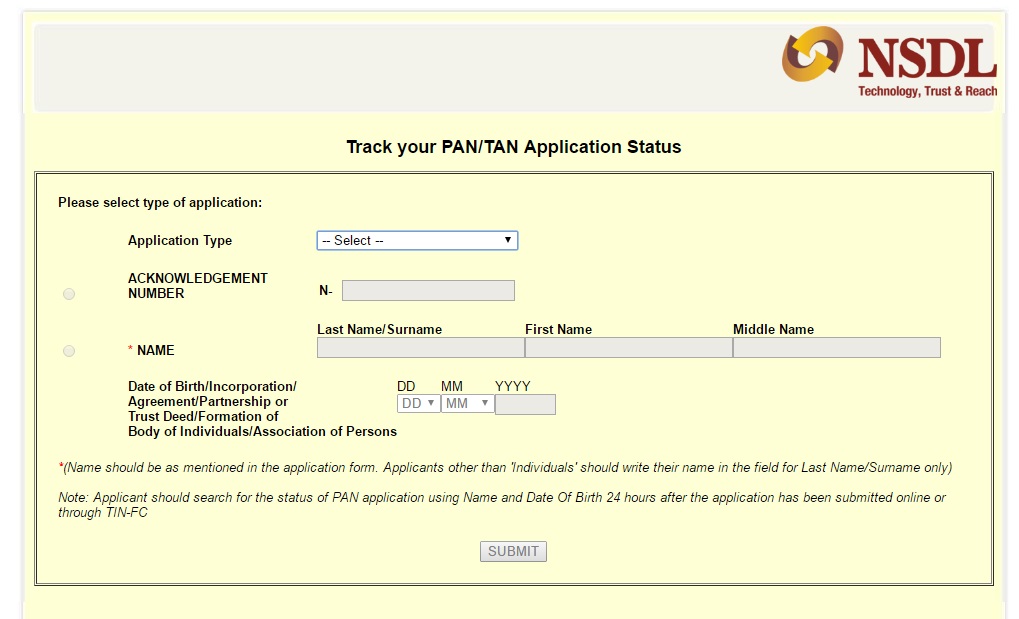

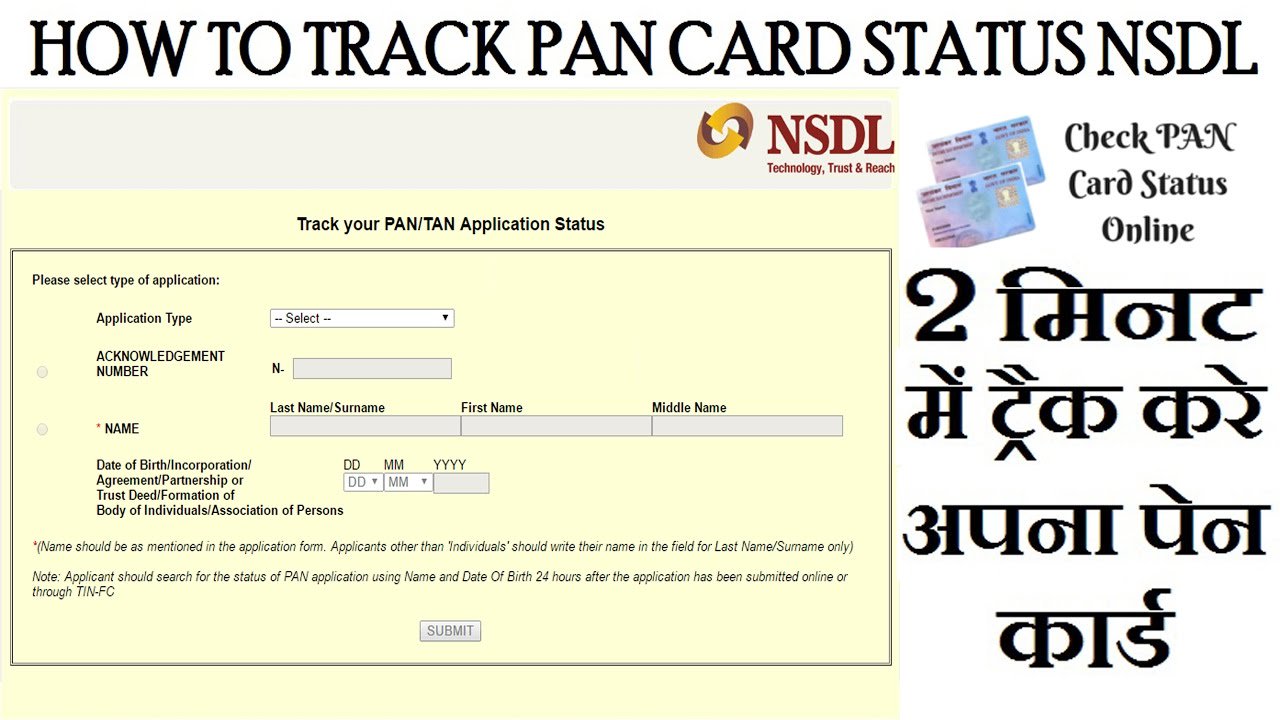

Please select type of application: सुशासन, विकास र समृद्धि सूचना अधिकारी. Search reset स्वेच्छिक कर सहभागितामा अभिवृद्धि :

Enter your acknowledgement number and click on submit button. Don’t put oil in it first, you’ll just burn. Track your pan/tan application status.

Select your id type as ‘income tax id. So, if you are wondering “how to check my pan card details online,” then follow these steps: You can also verify your pan with just your pan number by following the steps mentioned:

Enter the pan, full name (as per pan), date of birth and choose the 'status' as applicable. Here is how you can link your pan card with your aadhaar: Your pan is totally fine to just go into the oven to be preheated.

How to check pan details by pan number? The applicant can check pan details by pan number by carefully following the instructions. Click here to know the.