Peerless Info About How To Check Status Of My Tax Return

Tracking the status of a tax refund is easy with the where's my refund?

How to check status of my tax return. Check return status (refund or balance due) file and pay your taxes. Steps to check your tax return status: If you have questions or.

Your social security number or itin, your filing status (whether you're single, married, window, etc.),. The exact amount of the refund claimed on. To use the tool, taxpayers will need:

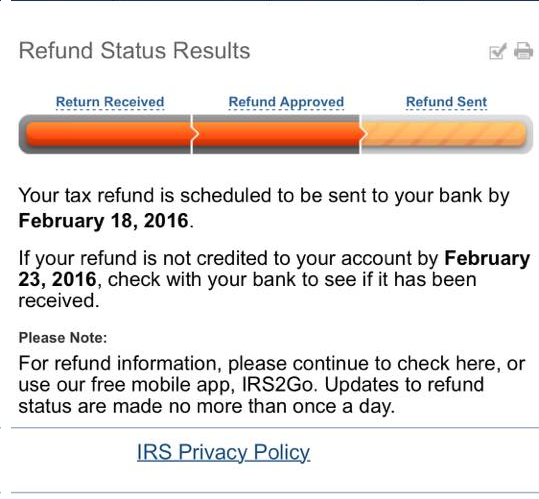

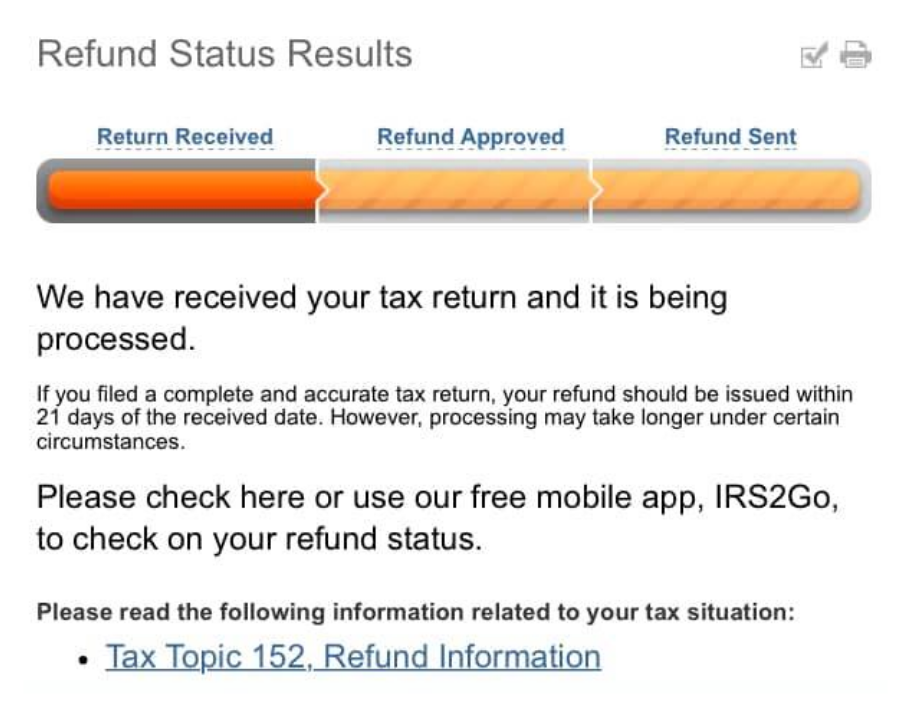

You will need to enter your ssn, your date of birth, your return type , the tax year and the refund amount shown. You can start checking on the status of your refund within 24 hours after the irs has received your electronically filed return, or 4 weeks after you mailed a paper return. Individual income tax return, for this year and up to three prior years.

Their social security number or individual taxpayer identification number. Call the irs refund hotline: You should notify your employer promptly of your new residence.

Check your refund status by phone before you call. Check in this order on this page detailing your refund status: Couldn’t find your refund with our tool or you filed a paper copy of your tax return?

Taxpayers can start checking their. All you need is internet access and this information: To check the progress of your tax return:

You'll need three pieces of information: Your efile account will show the status of your return and, if it has been accepted by the irs, you can then track your refund status. From the home page select manage tax returns;

Yes, for the period during which you were not a resident of new york. Their social security number or individual taxpayer identification number. Tax refund dates, tax refund status, then;

To use the tool, taxpayers will need: System, you can check the status of your minnesota tax refund. Check your federal tax refund status.

Then select the income year. Enter this overpayment on line 34. To find out, visit the irs website.