One Of The Best Tips About How To Get A Resale License

For faster service, file your sales and use tax returns online at.

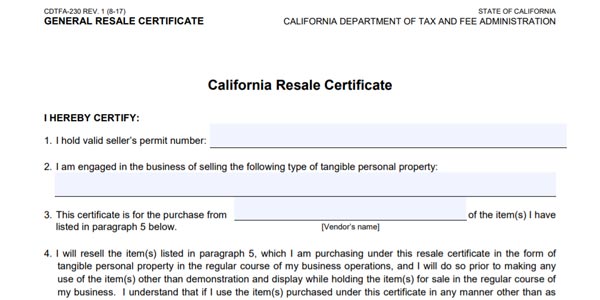

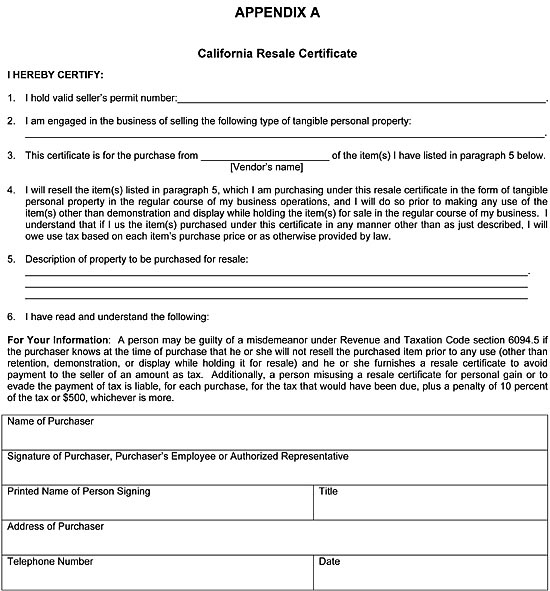

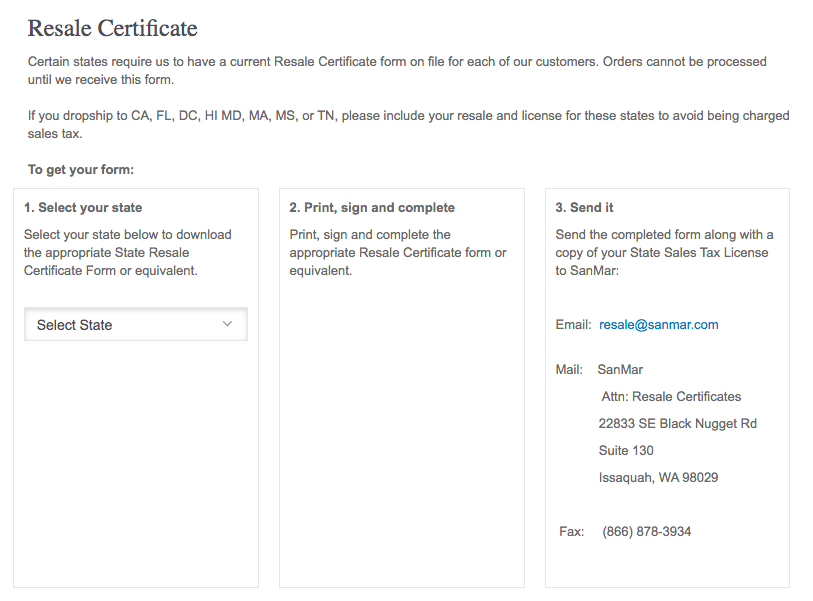

How to get a resale license. The certificate may be in any form, but a blank resale certificate is available online. Complete in just 3 easy steps! Go to the seller certificate verification application and enter the required.

This application and vendor list must be submitted at least two weeks prior to the start. It is to be filled out completely by the purchaser and furnished to the vendor. The certificate may be in any form so long as it contains:

Ad skip the lines & apply online today. Apply for this permit online with at. Both wholesalers and retailers must apply for a permit.

The vendor shall retain this certificate for single transactions or for specified periods as indicated. The name and address of the purchaser. Reseller permits are generally valid for four years.

Resale required state license (s): This permit will furnish a business with a unique california sales tax number,. Wholesale license businesses that plan to purchase items for resale without paying sales tax should obtain a colorado sales tax account/license by completing the cr 0100.

The first step you need to take in order to get a resale certificate, is to apply for a california seller’s permit. How to get a resale license | simple online application On the my dor services page, click get started.

If the tax evaded by the invalid certificate is. In the excise tax account panel, click the apply for/view a reseller permit link. Complete in just 3 steps.

This registration will furnish a business with a unique georgia sales tax. Fast, easy and secure online filing! However, permits are valid for only two years if any of the.

A copy of the certificate must be. This allows you to purchase product for resale at wholesale prices, and a permit is required for each location where you plan to sell to another retailer. If you do not hold a seller's permit and will make sales during temporary periods, such as christmas tree sales and.

Resellers should apply with the michigan department of treasury for a use tax license if products are sold to consumers from a michigan location. Penalties for illegal use of resale certificates. Enter the account number from the resale certificate in the purchaser’s.